Empower Your Wealth

Discover the Power of Mutual Funds for Financial Success

What is mutual funds?

Types of Mutual Funds

9 Benefits of Investing in Mutual funds in India

Professional Management

Diversification

Low Cost

SIP

Flexibility

Liquidity

Transparency

Variety

Tax Benefit

Advantages of Mutual Fund

Advantages of SIP, STP and SWP

Systematic Investment Plan

- Disciplined payment/investment habit

- Power of compounding

- Light on pocket

- Rupee cost averaging

Systematic Transfer Plan

- Consistent Returns

- Cost Averaging

- Rebalancing of Portfolio

Systematic Investment Plan

- Regular Income

- Avoids Market Fluctuation

- Tax Efficient

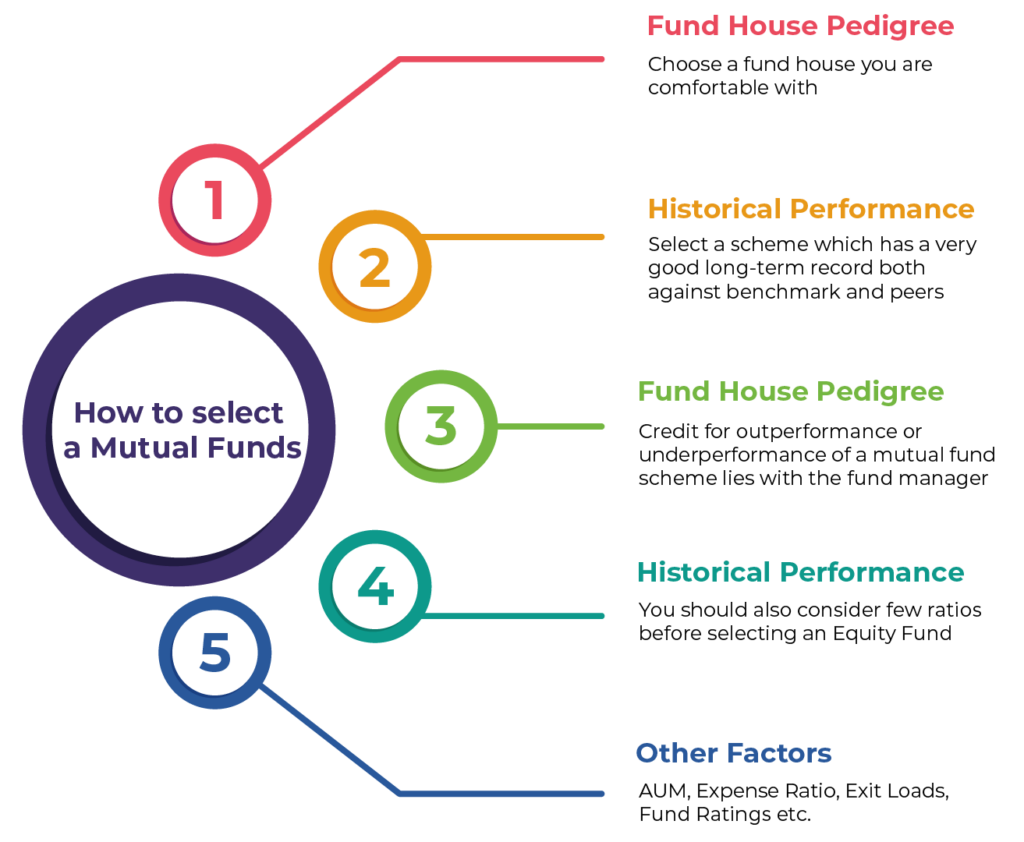

How to select a Mutual Fund

Taxation on Mutual Funds

| Type of Mutual Fund | Short-Term Capital Gain (Holdings of less than 1 year) | Long Term Capital Gain (Holdings of more than 1 year) |

| Equity Mutual Fund | 15% | No LTCG up to 1 lakh. 10% on LTCG above 1 lakh without any indexation benefits |

| Debt Mutual Fund | As per the Income Slab | As per the Income Slab |

| Hybrid Equity-Oriented Mutual Fund | 15% | No LTCG up to 1 lakh. 10% on LTCG above 1 lakh without any indexation benefits |

| Hybrid Debt-Oriented Mutual Fund | As per the Income Slab | As per the Income Slab |

| Liquid Funds | As per the Income Slab | As per the Income Slab |

| Dividend Income | As per the Income Slab | As per the Income Slab |