Discover your path to financial freedom with a free no-obligation call

-

Multiple Investment

Options

-

Digital

KYC

-

Zero

Costs

Crafting Your Journey to Financial Triumph: Unlock Your Potential for Unparalleled Success

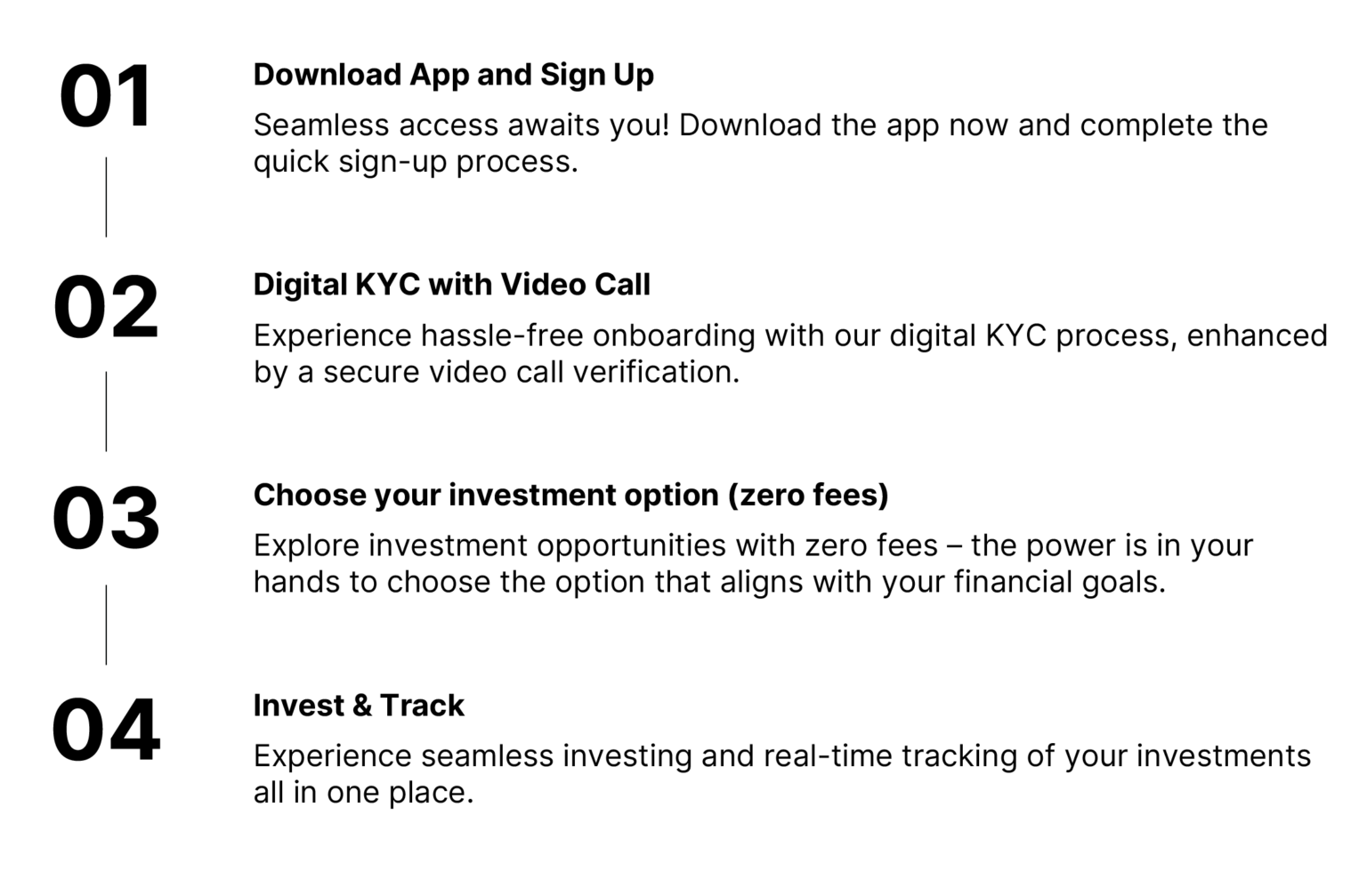

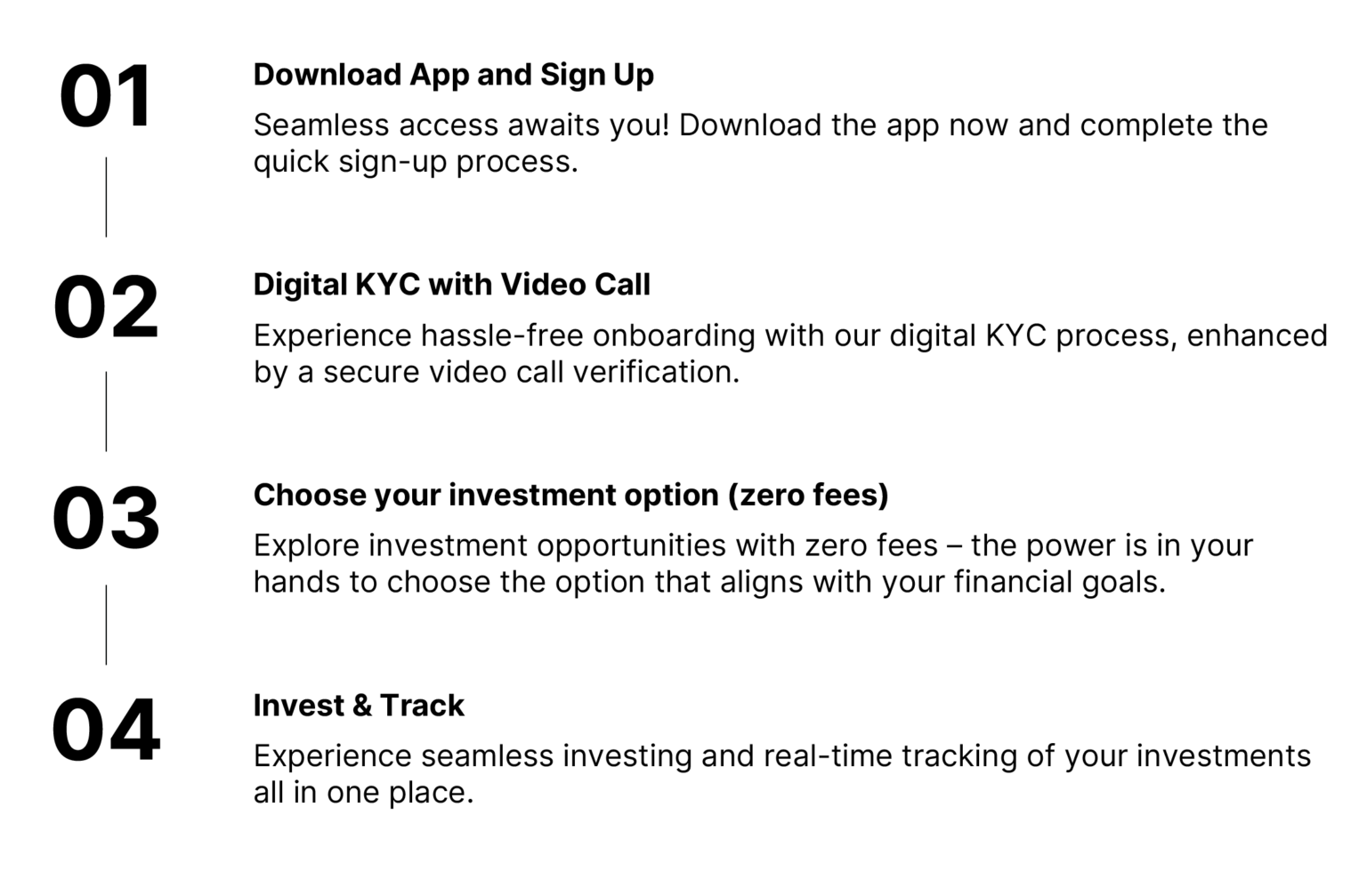

Invest with us with simple steps

- 1. Download App and Sign Up

- Seamless access awaits you! Download the app now and complete the quick sign-up process.

- 2. Digital KYC with Video Call

- Experience hassle-free onboarding with our digital KYC process, enhanced by a secure video call verification.

- 3. Choose your investment option (zero fees)

- Explore investment opportunities with zero fees – the power is in your hands to choose the option that aligns with your financial goals.

- 4. Invest & Track

- Experience seamless investing and real-time tracking of your investments all in one place.

Invest with us with simple steps

Our Products

Mutual funds are investment vehicles that pool money from various investors to collectively invest in a diversified portfolio of Stocks, Bonds, or Other Securities. These funds are managed by professional fund managers, who make investment decisions on behalf of the investors.

Mutual funds are investment vehicles that pool money from various investors to collectively invest in a diversified portfolio of Stocks, Bonds, or Other Securities. These funds are managed by professional fund managers, who make investment decisions on behalf of the investors.

Mutual funds are investment vehicles that pool money from various investors to collectively invest in a diversified portfolio of Stocks, Bonds, or Other Securities. These funds are managed by professional fund managers, who make investment decisions on behalf of the investors.

Mutual funds are investment vehicles that pool money from various investors to collectively invest in a diversified portfolio of Stocks, Bonds, or Other Securities. These funds are managed by professional fund managers, who make investment decisions on behalf of the investors.

Finspire’s Simple, Fast and Effective Process

01

Schedule Call

(no obligation call)

02

Identify Goals

03

Create tailored plan

04

Plan appropriate investments

05

Review & monitor investments

Our Products

Our Products

01

Mutual Funds

Learn More >

02

Fixed Deposit

Learn More >

03

Insurance

Learn More >

04

Commercial Real Estate

Learn More >

05

Micro VC

Learn More >

06

Pre IPO

Learn More >

Our Products

Return on Investments

|

Asset |

Est. Return |

Min. Amount |

Holding Period |

Risk |

Can NRIs Invest? |

|

Fixed Deposit |

7 - 8.5% |

1,000 |

3 months+ |

Low |

Yes |

|

Bonds |

9 - 11% |

1,000 |

1 yr + |

Low - Med |

Yes |

|

Mutual Funds |

10 - 18% |

1,000 |

3-7 yrs |

Med - High |

Yes |

|

Commercial Real Estate |

14 - 16% |

50 Lakh + |

5 – 7 yrs |

Low |

Yes |

|

Pre-IPO |

18 - 25% |

20,000 |

3 4 yrs |

High |

Yes |

|

Asset & Inventory Finance |

18 - 20% |

20,000 |

6 month – 3 yrs |

Med - High |

Yes |

|

Micro VC Fund |

1-100x |

25 Lakh+ |

5 – 7 yrs |

Very High |

Yes |

Our Services

Global Investing

Be a FAANG Advisor, Invest Globally

MFDs, Do your clients dream of investing in Apple, Tesla, Facebook,

Amazon, Netflix, or Google?

Now, you can turn their dream into reality by helping them invest in these

global giants with REDVision.

Get access to 4,000+ stocks & 3,000+ ETFs at your fingertips.

Global Investing

Be a FAANG Advisor, Invest Globally

MFDs, Do your clients dream of investing in Apple, Tesla, Facebook,

Amazon, Netflix, or Google?

Now, you can turn their dream into reality by helping them invest in these

global giants with REDVision.

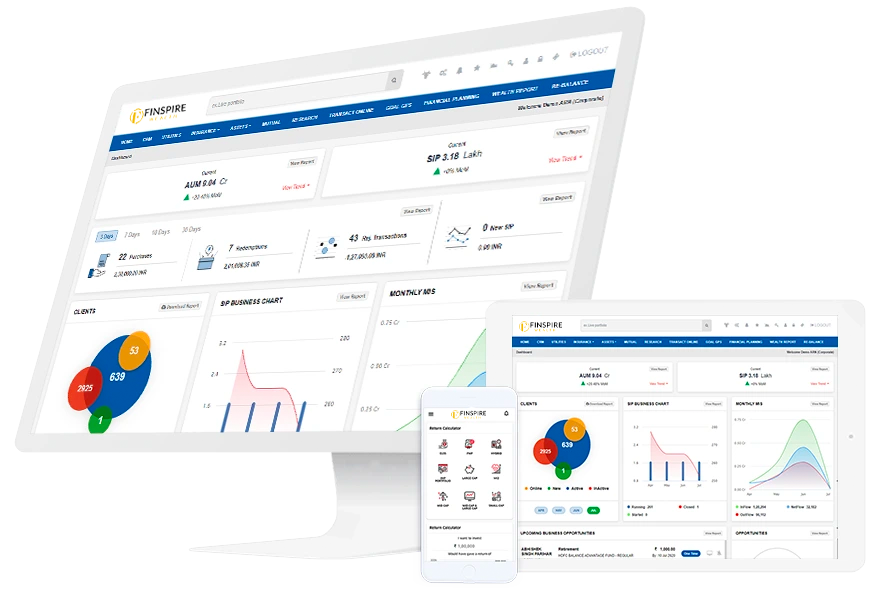

Get access to 4,000+ stocks & 3,000+ ETFs at your fingertips. BSE NSE Tab Online Transactions

Get integrated with secured online transaction portal such as NSE NMFII or BSE StarMF to place transactions instantly from anywhere. Bulk Client Onboarding Welcome numerous numbers of investors at a same time with no extra formalities and heavy documentations. Bulk Transactions No limits on performing transactions to experience the high rate of market returns through buy, sale, and switch. Sort AMC’s Categorize and choose among the top AMC’s to encourage clients for making investment in the recommended schemes.

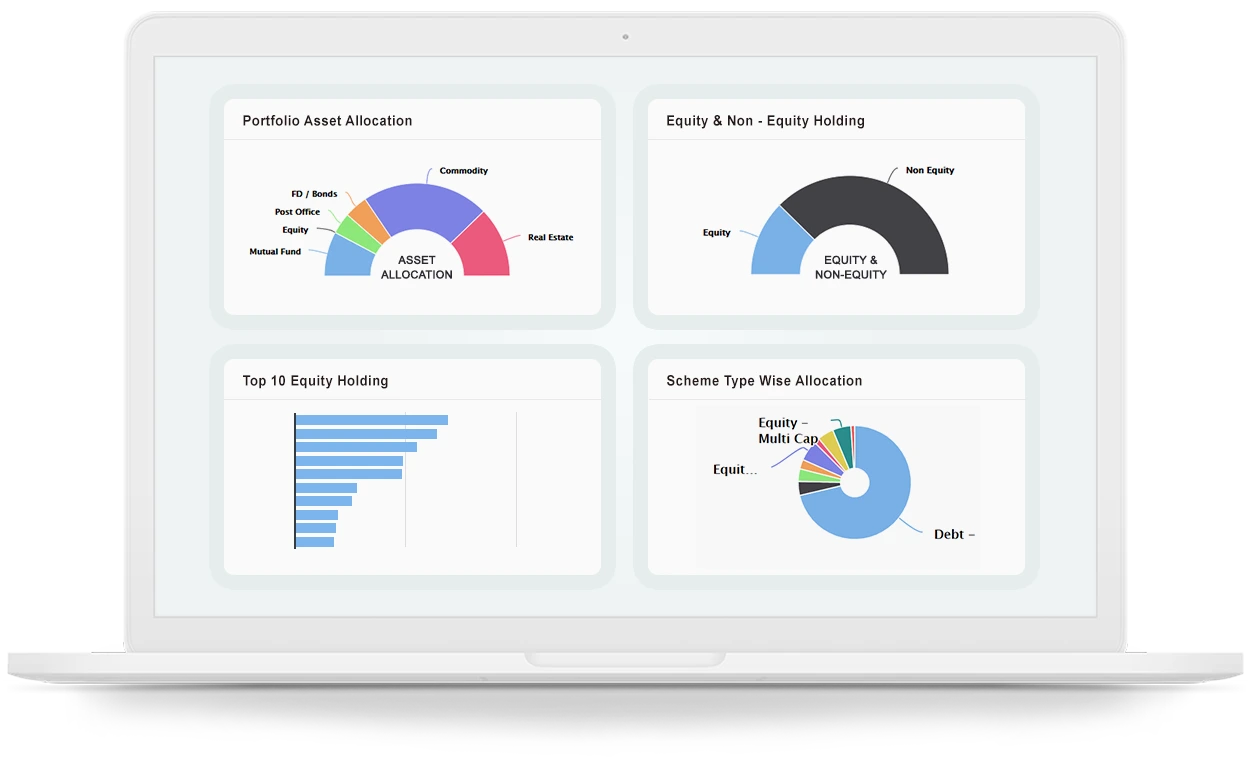

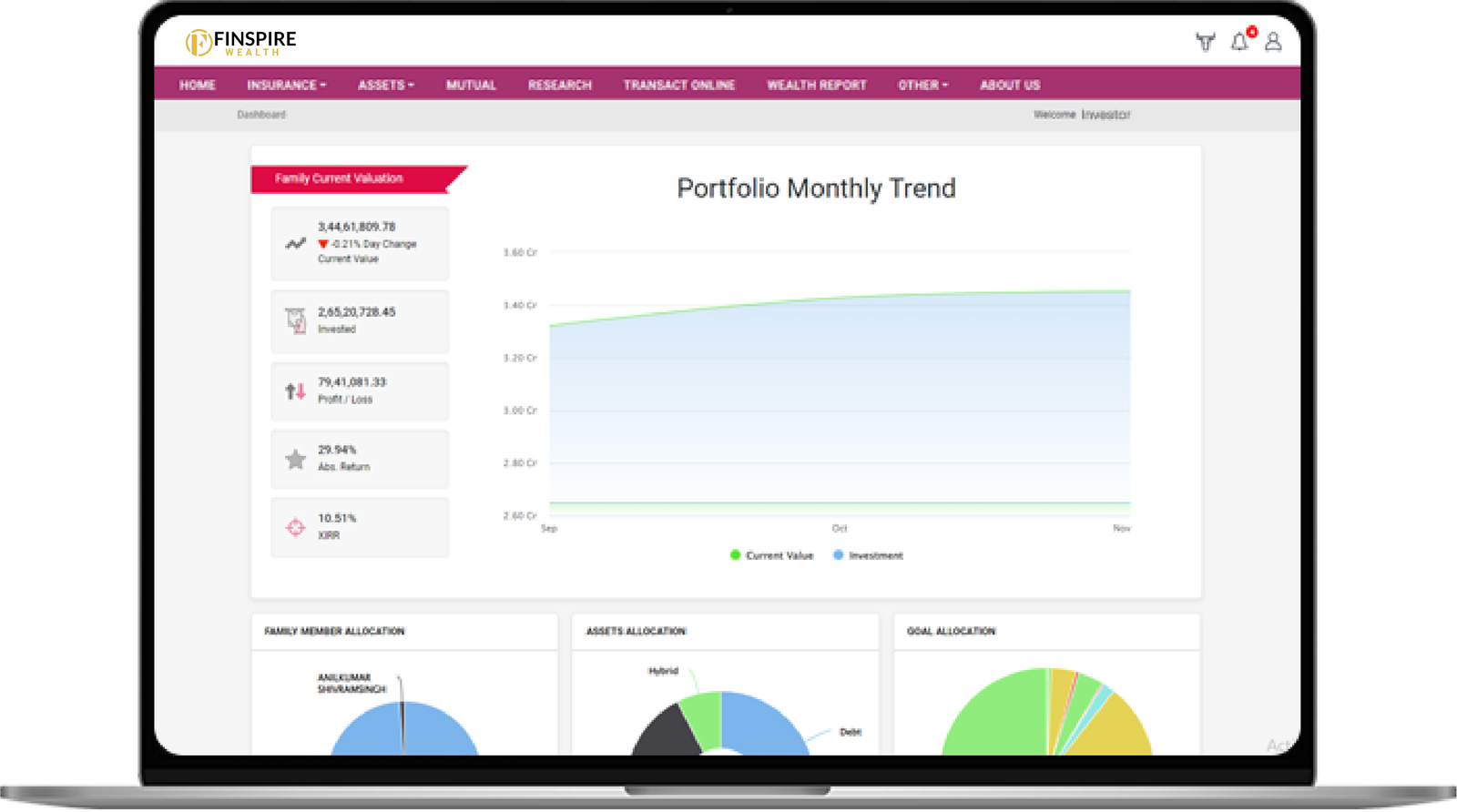

Bird Eye View for 20+ Assets!

Advisor can take better decisions when he have the information of complete portfolio, wealth elite is a single platform to manage Mutual Funds, Life Insurance, General Insurance, Health Insurance, Direct Equity, Postal, FD, Bonds, Commodities, Real Estate, PPF, PF, PMS, Venture Capital Funds, Alternative Investments, Arts & Antiques etc. The Best part is all this assets can be link with investor’s Goal financial planning to track the progress and achievements.

Goal Tracker – Embedded with BSE/NSE.

Goal Tracker – Embedded with BSE/NSE.

Investments cycle revolved around FEAR, GREED & HOPE, we added LOVE.

Our Goal Tracker allow advisor to customize the Goal tacking report by adding investor’s family & kids photos with the report.

Advisor can Map all Assets with the Goal & in case of any deficit the advisor can place future orders of mutual funds via BSE/NSE from the Goal Tracker.

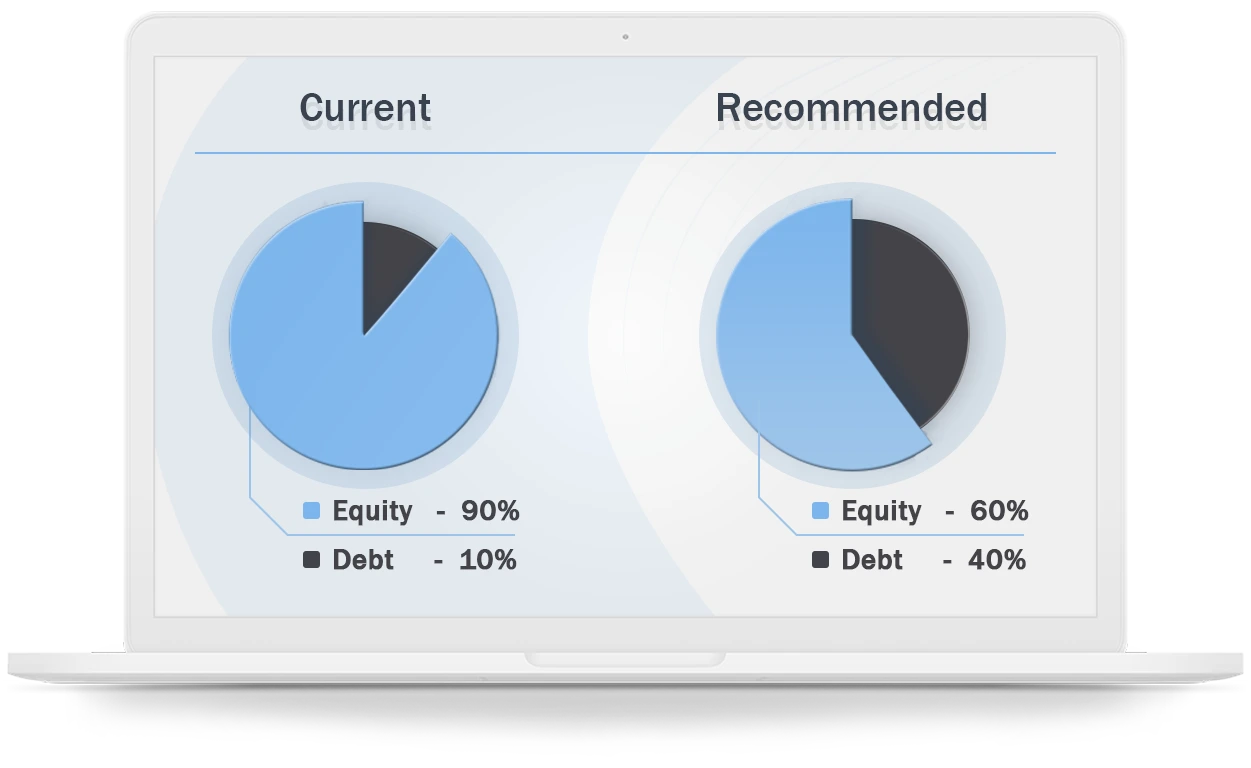

Portfolio Re-Balancing with BSE & NSE Integration!

Portfolio Re-Balancing with BSE & NSE Integration!

Our Portfolio Re-Balancing feature in Mutual Fund Software allows you to book profit at pick and invest at bottom by just a click, the modules is integrated with BSE & NSE, so that the switch order can be placed directly from Rebalancing report, this product engineering a portfolio can be more profitable and less risky.

Strategies offered in our platform:

- Fixed Time Interval based rebalancing.

- Percentage change based rebalancing.

Research Tools Mutual Fund Software for Distributors allows conducting research through Model Portfolio, Funds Factsheet, SIP/STP/SWP Past performance Calculator, Human life Value Calculator, SIP Calculator, Loan EMI Calculator, FD Calculator, Child Marriage planning Calculator, Child Education Planning Calculator, Retirement Planning Calculator, Dividend History, Latest & Historical NAV Watch, Income Tax Calculator, SIP Delay Cost calculator

Research Tools Mutual Fund Software for Distributors allows conducting research through Model Portfolio, Funds Factsheet, SIP/STP/SWP Past performance Calculator, Human life Value Calculator, SIP Calculator, Loan EMI Calculator, FD Calculator, Child Marriage planning Calculator, Child Education Planning Calculator, Retirement Planning Calculator, Dividend History, Latest & Historical NAV Watch, Income Tax Calculator, SIP Delay Cost calculator

Financial Planning – Generate 40 pages Professional Financial Plans in minutes. The best Mutual Fund Software in India that Generate complete financial plans with Insurance need analysis, post retirement cash flow, Goal report with client’s photo, Asset Allocation recommendations, Net worth analysis, solvency ratio and many more.

Financial Planning – Generate 40 pages Professional Financial Plans in minutes. The best Mutual Fund Software in India that Generate complete financial plans with Insurance need analysis, post retirement cash flow, Goal report with client’s photo, Asset Allocation recommendations, Net worth analysis, solvency ratio and many more.

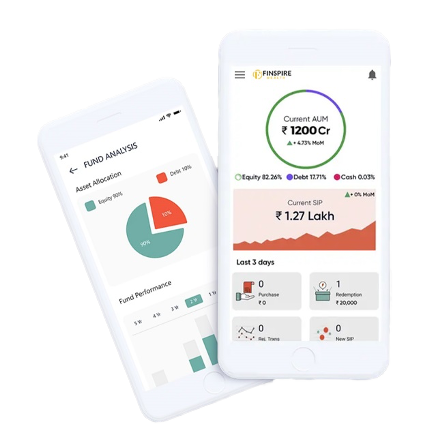

Investment Simplified for Indians Everywhere

Our team will work closely with you to develop a customized wealth management plan that takes into account your unique needs and objectives.